All Photos by Susan Kime unless noted otherwise

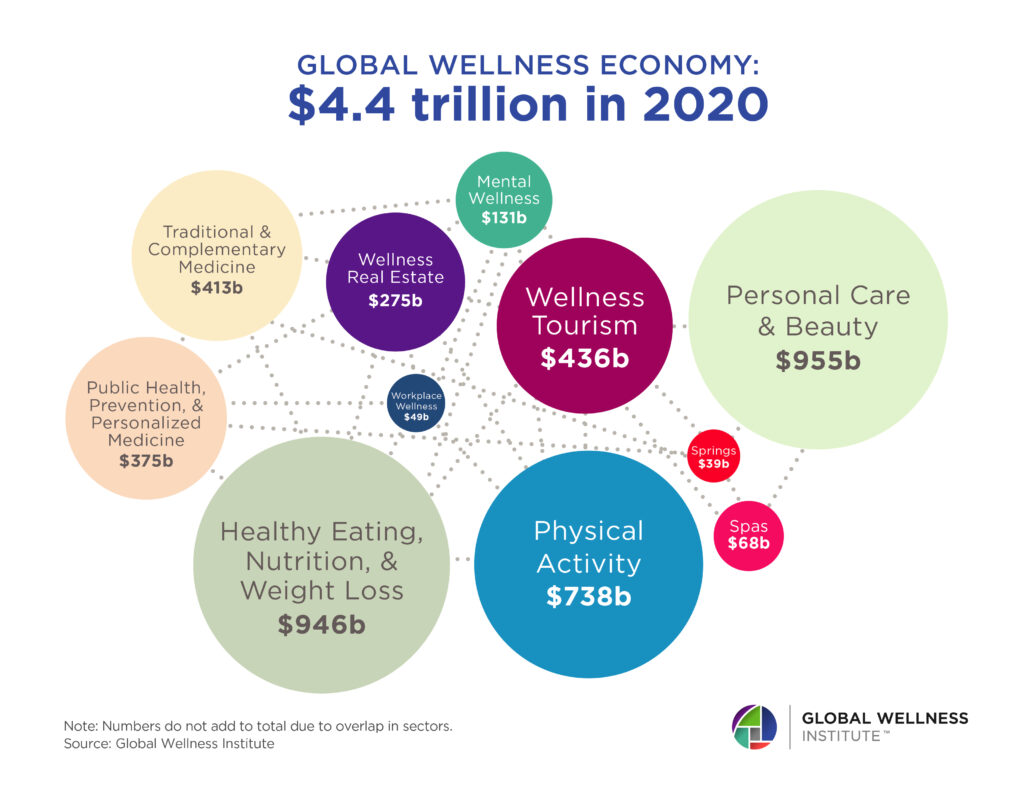

The new Global Wellness Institute research, the most in-depth in its history, reveals that the wellness market grew to a record $4.9 trillion in 2019 and then fell to $4.4 trillion in the pandemic year of 2020. But with consumer values shifting underway, the future of the wellness market is predicted to grow 10% annually through 2025. The report was unveiled at the Global Wellness Summit, held in Boston from November 30-December 3rd, 2021. We were there.

The research report, “The Global Wellness Economy: Looking Beyond Covid” provides new global market data on the overall wellness economy and for each of its sectors. The highlights are below:

The GWI last measured the wellness industry at $4.3 trillion in 2017, and the new research reveals that it grew to historic levels in the two years before the pandemic, reaching $4.9 trillion in 2019. But with massive economic shocks from COVID-19, the global wellness economy fell 11%, to $4.4 trillion, in 2020.

However, with the pandemic ushering major shifts in values for consumers, governments, and the medical world, where prevention and wellness take on greater importance, the GWI predicts that the wellness market will return to pre-pandemic levels in 2021 ($5 trillion), and will grow at an impressive 10% annual pace through 2025, when it will reach $7 trillion.

Unsurprisingly, sectors requiring a physical presence and/or full immersion for the actual experience, including physical activity, wellness tourism, spas, and thermal/mineral springs, saw the biggest pandemic declines–while healthy eating/nutrition/weight loss, wellness real estate, mental wellness, and the public health/prevention/personalized medicine category all showed strong pandemic growth. For the first time, the research breaks down the total wellness economy for each global region.

The Asia-Pacific was one of the fastest-growing wellness markets from 2017 to 2019 (8.1% growth), and it also shrank the least during the pandemic (-6.4%).

Plenary Meeting:Global Wellness Intitute Presentation

Conversely, North America was the fastest-growing wellness region from 2017 to 2019 (8.4%), but among the hardest hit by the pandemic (-13.4%). Asia-Pacific had the largest wellness market in 2020 ($1.5 trillion), followed by North America ($1.3 trillion), and Europe ($1.1 trillion). Per capita spending on wellness is significantly higher in North America ($3,567) and Europe ($1,236) than in other global regions.

The growth projections for wellness markets 2020-2025 are defined by numbers referring to the 2020 market, the 2025 market, and average annual growth rate

Wellness Tourism: $436 billion––$1.1 trillion––+21%

Thermal/Mineral Springs: $39 billion––$90 billion––+18%

Spas: $69 billion––$150.5 billion––17%

Wellness Real Estate: $275 billion––$580 billion––+16%

Physical Activity: $738 billion––$1.2 trillion––+10.2%

Mental Wellness: $131 billion––$210 billion––+9.8%

Personal Care & Beauty: $955 billion––$1.4 trillion––+8%

Traditional & Complementary Medicine: $413 billion––$583 billion––+7%

Healthy Eating, Nutrition & Weight Loss: $945.5 billion––$1.2 trillion––+5%

Public Health, Prevention & Personalized Medicine: $375 billion––$478 billion––+5%

Workplace Wellness: $48.5 billion––$58 billion––+4%

Wellness Market Snapshots and Takeaways:

Wellness Tourism (pandemic loser, future winner): Grew 8% annually from 2017 to 2019 (reaching $720 billion) and then took a major hit in 2020. The market shrunk -39.5% to $436 billion, while wellness trips dropped from 936 million to 601 million. The impressive 21% annual growth rate projected for wellness tourism through 2025 reflects new traveler values (a quest for nature, sustainability, mental wellness) as well as a period of rapid recovery from pent-up demand in 2021 and 2022.

Thermal/Mineral Springs (pandemic loser, future winner): One of the fastest-growing wellness markets from 2017 to 2019, with revenues rising from $56 billion to $64 billion (6.8% annual growth). Hit hard by the pandemic, revenues fell -39% in 2020, shrinking the market to $39 billion. There are now 35,099 hot springs establishments across 130 countries. The downturn is temporary: Very strong 18% annual growth is expected through 2025, with 140-plus new projects in the pipeline.

Spas (pandemic loser, future winner): From 2017 to 2019, the spa industry was growing at a fast 8.7% annual rate and reached $111 billion in revenues across 165,714 spas–with a big jump in hotel/resort spas (from 48,248 to 60,873). The high-touch industry was hit hard in 2020: Revenues fell by -39% (to $69 billion) and spa establishments dropped to 160,100 (with a loss of over 4,000 day spas). But the industry is expected to recover quickly, with the market growing 17% annually through 2025, and more than doubling revenues (to $150.5 billion.)

Wellness Real Estate (pandemic and future winner): With COVID-19 dramatically accelerating the understanding of the role that the built environment and our homes play in our physical and mental health, the wellness real estate market was the #1 growth-leader both before and during the pandemic: The market grew from $148.5 billion in 2017 to $225 billion in 2019 to $275 billion in 2020 (22% annual growth). Wellness residential projects (either built or in the pipeline) skyrocketed from 740 in 2018 to over 2,300 today. Wellness real estate will continue its growth surge: The market will double to $580 billion from 2020 to 2025 (16% annual growth.)

Physical Activity (pandemic loser, future winner): This six-sector market grew 5% from 201

Sitting on large balls intead of chairs helps posture and overall wellness.

Workplace Wellness (pandemic loser, future winner, with a difference): This segment grew 4.6% annually from 2017 to 2019–reaching a market high of $52.2 billion–but then shrank 7% in 2020, to $48.5 billion. Companies are recognizing that a compartmentalized, programmatic approach to employee wellbeing is not particularly effective in tackling the rising challenges of stress, work-life balance, and mental health, so many are shifting to more meaningful, holistic approaches encompassing everything from changing company culture to focusing on the built environment. These expenditures cannot be measured as “workplace wellness,” so expenditures may decline even as the focus on employee wellbeing actually expands. Even so, the market is pegged to grow 4% annually through 2025, reaching $58.4 billion.

Global Wellness Institute

“The wellness economy will grow to $7 trillion in 2025, because the forces that have been driving it remain as powerful as ever: an expanding global middle class, an aging population, and rising chronic disease,” said Katherine Johnston, GWI senior research fellow.

“But the pandemic,” she continues, “has brought new shifts and a global values reset:

Wellness now means far more than a facial or spin class. It has now an emerging, growing focus on mental wellbeing, importance of work-life balance, social justice, environmental sustainability, the built environment, and public health. These drivers will underpin the recovery of the wellness economy; they will also shift consumer, policy and healthcare spending in new directions.”

www.globalwellnessinstitute.org

Susan Kime – We were there.